◆ Israel 지정학적 이슈에도 반등 (Hamas open to talk with Israel 뉴스 전부터 반등) … 금리 크게 하락 … Short squeeze continues

- U.S. Index: S&P500 +0.63%, Nasdaq +0.49%, Dow +0.59%

- U.S. Rate: 2Y 4.932% (-15.3bp), 5Y 4.568% (-19bp), 10yr 4.638% (-16.7bp), 30yr 4.84% (-13.4bp)

- U.S. Equity: 필라델피아 반도체 -0.25%, 필라델피아 은행 0.1%, Big Tech주 0.68%

- Gamma Index: SPY -0.335, QQQ -0.062, IWM -0.124

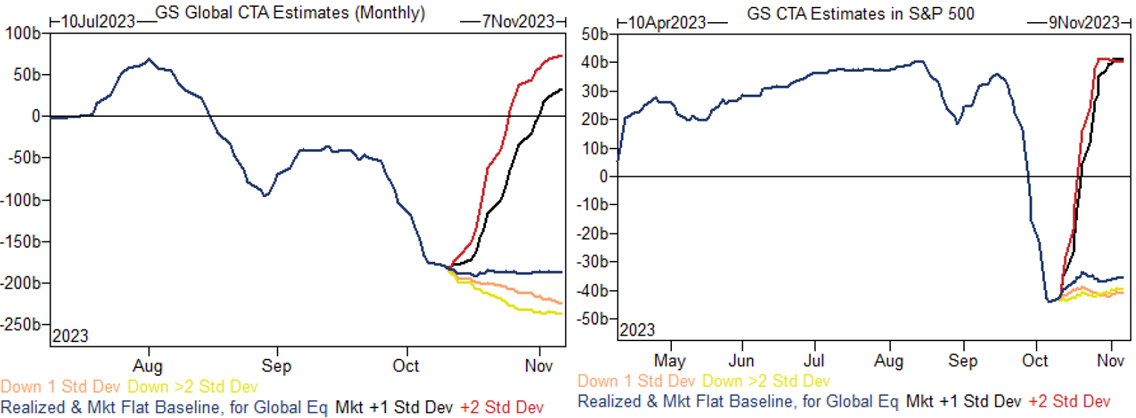

◆ CTA … Heavily short across globe and U.S. (Source: GS)

- CTA on Global equity @ 0%tile … -$90 billion short (S&P500 -$47 billion short)

- CTA 發 S&P500 short covering coming? … 모든 시나리오 상에서 1개월 동안 CTA buying 할 것으로 GS 추정

- S&P500 trigger point … Short-term 4,397 / Medium-term 4,353 / Long-term 4,302

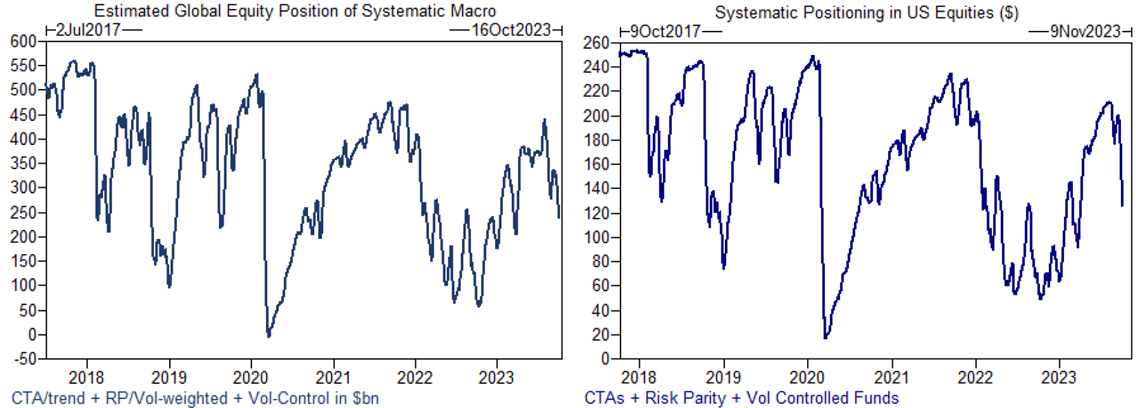

- Systematic 또한 지난 2주 동안 매도세 … 現 Neutral 상태로 전환

- VIX 상승세 지속되지 못하고 있는 상황 … Realised Vol 13% vs. Implied Vol 18% … 지난 3일간 IV 하락 中

◆ Earning season kicks off (Source: GS)

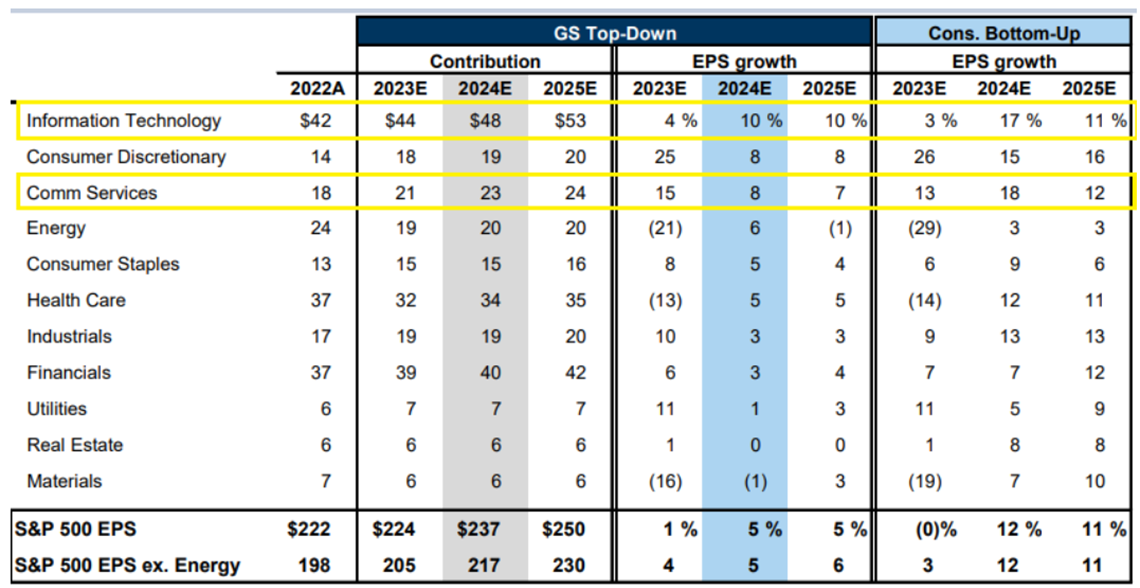

- Who is right? … '24年 EPS 기대치 반영될 시기 (Oct ~ Nov)

- Top-down '24年 EPS to be revised up (from +5%)

- Bottom-up to be revised down (from +12%)

- Perhaps simultaneous revision (up or down?)

- Bottom-up '24年 EPS growth

… IT +17%, Consumer Discretionary +15%, Comm. Services +18%, Health Care +12%, Industrials +13% - 금주 금융주 실적 발표 예정 … Interesting sector … '24年 Top-down +3% vs. Bottom-up +7%

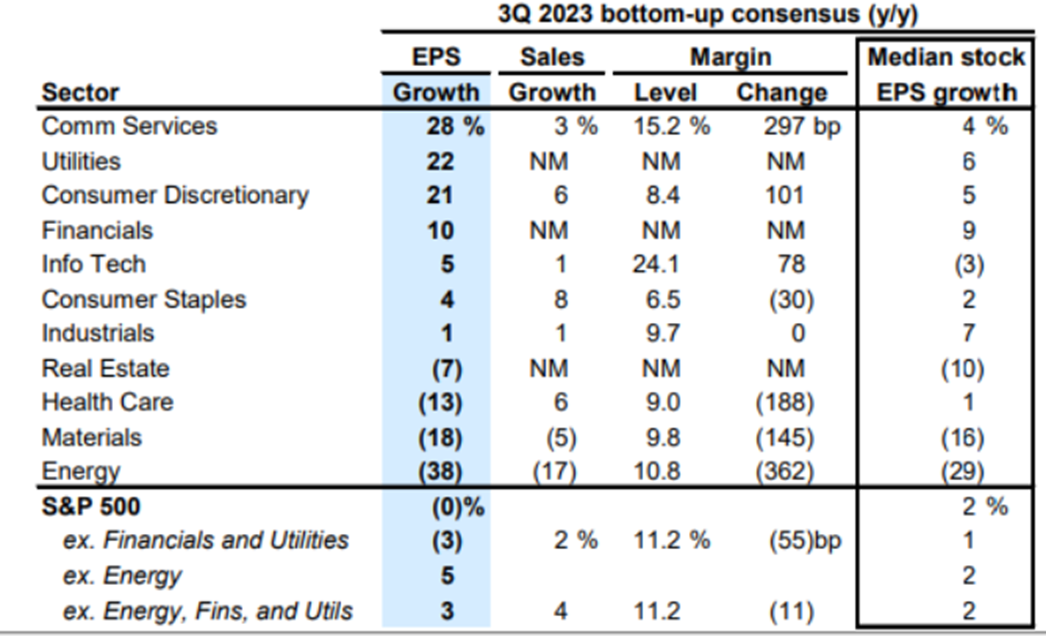

- 3Q23 큰 폭 성장 기대하는 bottom-up analysts … Sales growth 보다 수익성 개선을 크게 기대하는 시장

- 전년도 10月 CPI YoY 성장률 최고치 … 비용 부담 완화에 대한 반영

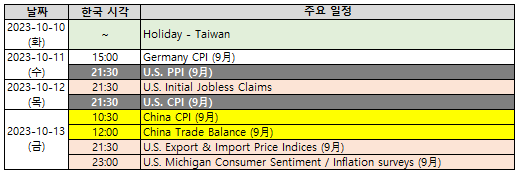

◆ 주요 일정

728x90