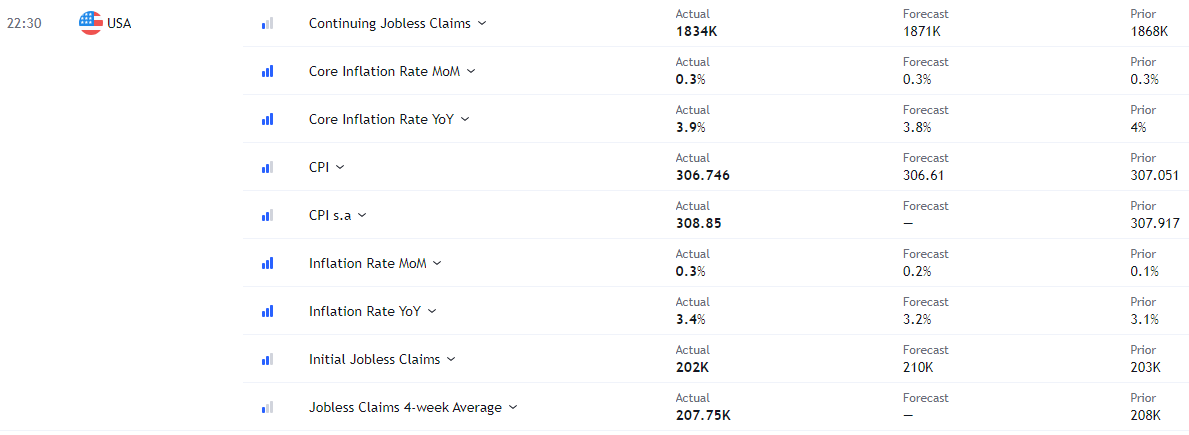

◆ On CPI releases,

- Headline & Core CPIs 추정치 동반 상회 ... 작년 연초 이후 최초

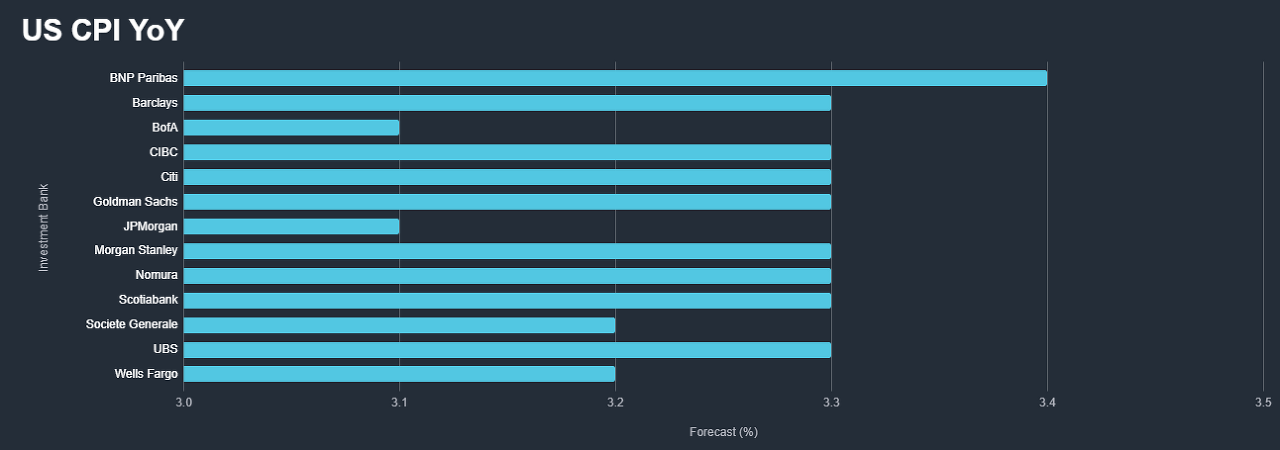

- BNP Paribas 유일하게 hawkish ... 12月 Headline & Core CPI 상승률 예상 성공

- BNP는 1H24 disinflationary impulse 유지될 것이지만, 2H24에는 조심해야 할 것으로 추정

- BNP는 Headline CPI가 sticky 할 것이지만, FED path를 변화시킬 정도는 아닐 것으로 추정 (= No rate hikes)

- 시장의 기대는 3月 금리 인하 ... vs. BNP 5月 금리 인하 전망

◆ U.S. CPI 오랜만에 상회 … (Source: TradingView, FinancialJuice)

- Headline & Core CPIs 동시 상회 … 작년 3月 (2月?) 이후 최초로 두 항목 동시 상회

- Headline CPI 추정치 … Hawkish BNP Paribas YoY 3.4% (MoM +0.3%) 성공적으로 추정

(Core 또한 MoM +0.3% 추정하며 Headline & Core 동시 적중) - 시장은 하락 후 반등 ... Why? (= 큰 그림은 변하지 않는다?)

◆ BNP Paribas on Inflations … (Source: BNPP)

- Inflation is cooling, but FED to mind upside risks over the near term.

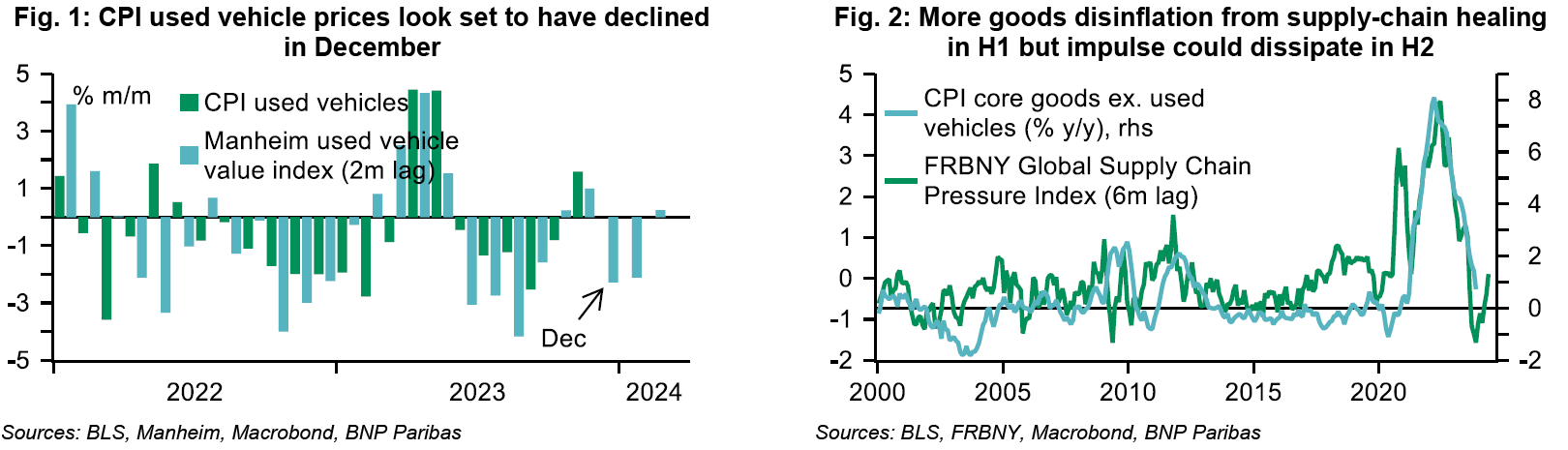

→ Expect the FED to hold off on rate cuts a bit longer than markets expect, waiting until the May FOMC meeting. - Disinflationary impulse from supply-chain healing has further room to run (~ 1H24)

→ However, the disinflationary impulse to goods inflation could dissipate (by 2H24)

(New York Fed’s global supply chain pressure index has recently rebounded and now at neutral)

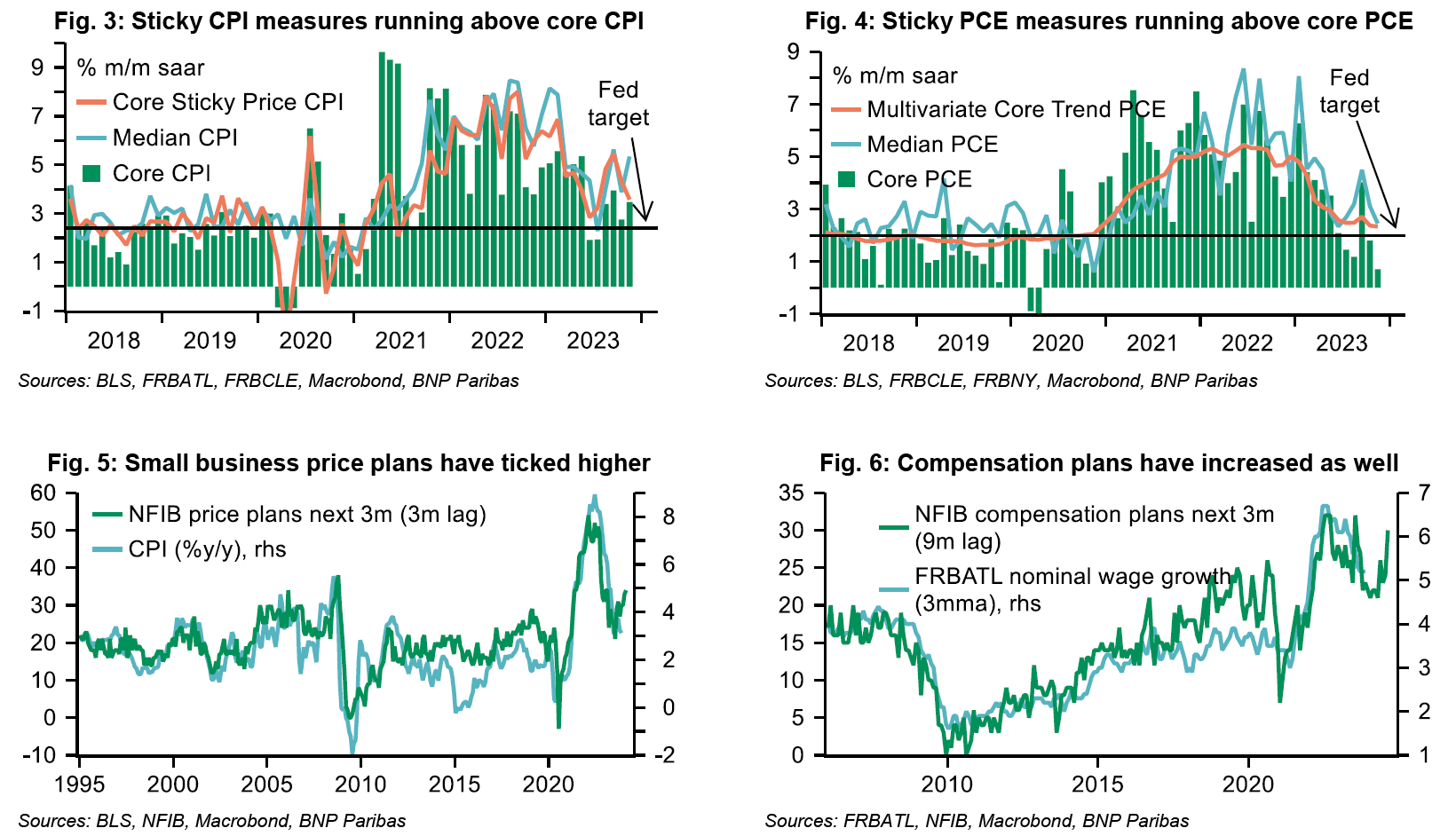

- Core PCE near target, but underlying inflation measures remain stickier and businesses appear to be planning for

higher wages and prices.

→ Headline CPI remains sticker vs. both core PCE and core CPI to be soften - Disinflation to enable Fed to cut in May, officials likely wary to ease policy before then.

→ December FOMC minutes: Cuts coming but not so fast. Some still worries on inflation resurgence.

728x90